Government Guarantee Scheme MADANI (GGSM)

The Government Guarantee Scheme MADANI (GGSM) is a powerful financial support initiative introduced by the Malaysian government to uplift SMEs and micro-enterprises across the country. This scheme, anchored under the broader MADANI framework, is strategically designed to foster economic inclusivity, enhance financial resilience, and drive equitable growth among businesses that often face challenges accessing traditional […]

Expand, Upgrade & Scale Your Business with GGSM 2 — Backed by the Malaysian Government!

If you’re an SME owner or business leader looking to grow, now is the time to take action. The Government Guarantee Scheme 2 (GGSM 2) is here to empower businesses like yours by offering accessible financing with government backing. This enhanced initiative is designed to make expansion easier, smarter, and more affordable than ever before. […]

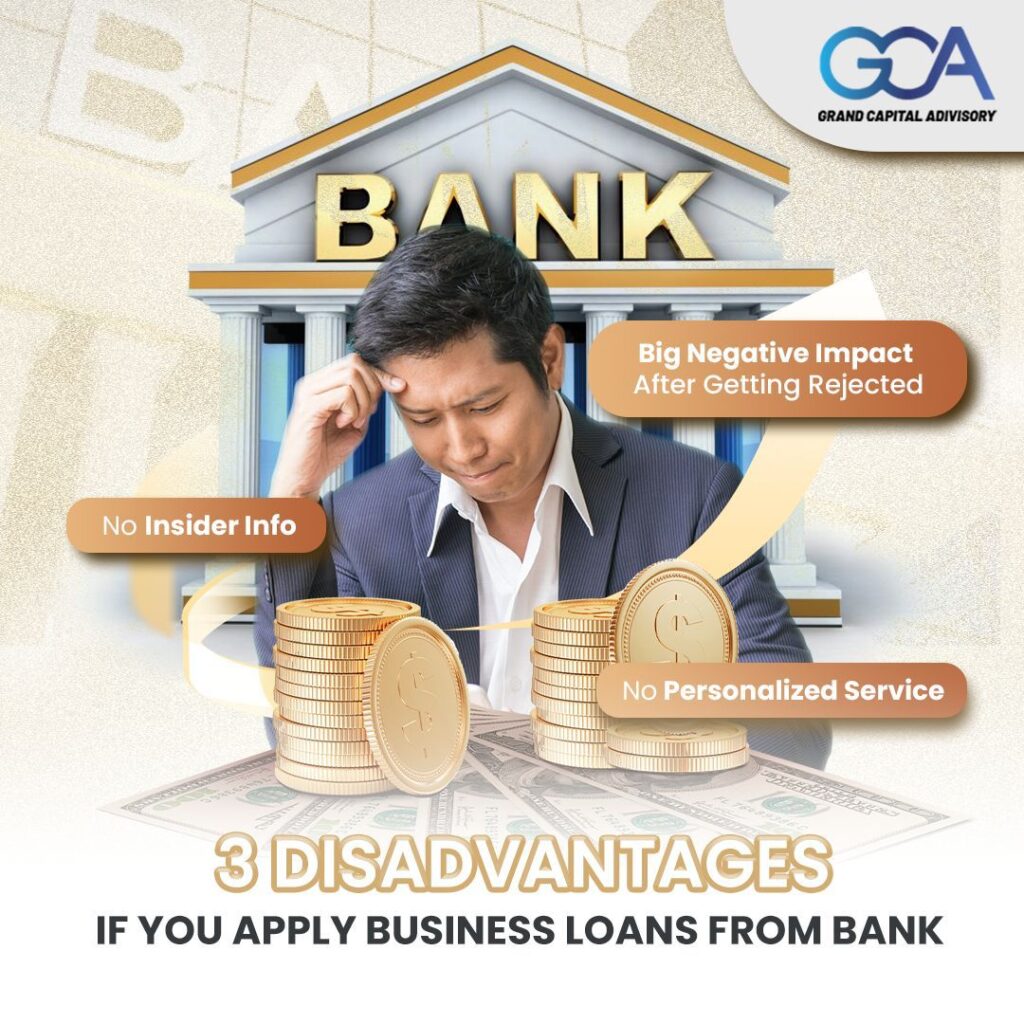

3 Reasons Why Applying Directly for a Business Loan from the Bank Could Be a Mistake

While approaching a bank for a business loan may seem like the most direct and logical step, many entrepreneurs and business owners are unaware of the potential downsides that come with going straight to the bank without proper guidance. At Grand Capital Advisory, we’ve seen how these overlooked disadvantages can significantly affect the outcome of […]

Need Funding to Grow Your Business? Here’s How GCA Capital Can Help

Securing business funding in today’s competitive financial landscape can be challenging—especially for startups, SMEs, or companies in niche industries. Many business owners struggle to get approved for the right loan amount, face long processing times, or feel lost in complex paperwork. At Grand Capital Advisory (GCA Capital), we understand these obstacles, and we’re here to […]

Why Your Credit Score Matters in Malaysia—and How to Improve It

In Malaysia, your credit score plays a pivotal role in your ability to access financial services and secure loans. Whether you’re applying for a home loan, a car loan, a credit card, or even business financing, your credit score is one of the first things financial institutions evaluate. A strong credit profile can open doors […]

What is CTOS and Why Is It Important for Your Financial Health?

In today’s credit-driven economy, having access to accurate financial data is essential—not just for lenders and banks, but also for individuals and businesses seeking to manage their creditworthiness. One of the most trusted and widely used credit reporting agencies in Malaysia is CTOS, which plays a critical role in helping users make smarter financial decisions. […]

Understanding Good Debt vs. Bad Debt: Make Smarter Financial Decisions for Your Business

Debt often carries a negative reputation, especially for those who associate it with financial stress or poor money management. However, in the business world, not all debt is bad. In fact, when used strategically, debt can become a powerful tool to build, expand, and sustain a successful enterprise. Whether you are running a startup or […]

Equipment Financing: A Strategic Investment for Business Growth

Purchasing large-scale equipment is a crucial move for businesses aiming to expand operations, boost productivity, or penetrate new markets. However, the high upfront costs involved can severely impact your cash flow. This is where strategic financing comes into play. At Grand Capital Advisory, we offer tailored financing solutions that empower businesses to grow without financial […]

Choosing Between Personal Loan vs. Business Loan: Which is Better for Your Business?

Securing funds for your business can be challenging but is vital for sustaining and growing your venture. When deciding between a personal loan or a business loan, it’s crucial to evaluate which option offers the most cost-effective and convenient solution for your needs. To make the best decision, consider the business financing services we offer […]

Financial Resolutions for 2025: Strengthen Your Business for Long-Term Success

As we step into 2025, businesses must reassess their financial strategies to ensure resilience and competitiveness in a rapidly evolving market. Whether you’re optimizing existing resources or exploring new opportunities, aligning your financial decisions with long-term goals is essential for thriving in the year ahead. Here are six key resolutions to help your business stay […]